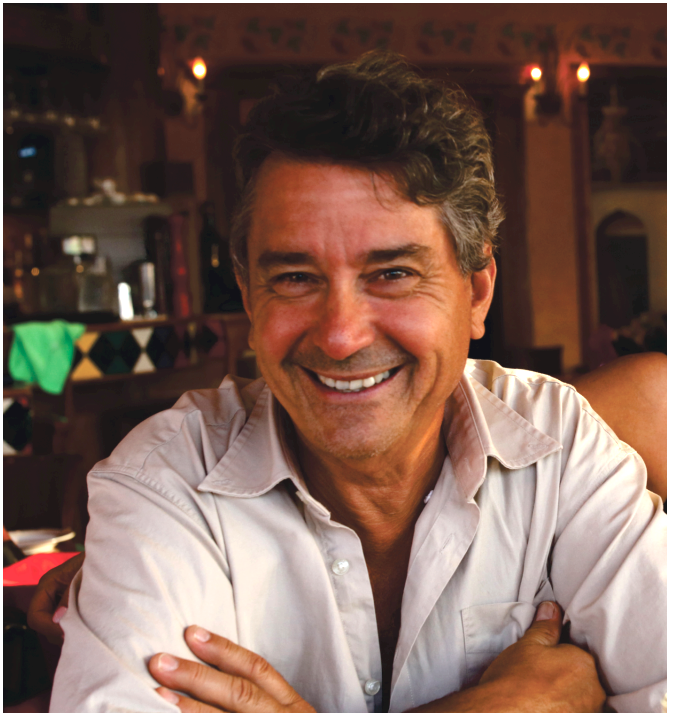

Last month, Peter Janis began recounting the early days of his career to illustrate how he developed crucial business skills over time. Here, he picks up where he left off—in 1992.

Last month, Peter Janis began recounting the early days of his career to illustrate how he developed crucial business skills over time. Here, he picks up where he left off—in 1992.

With a family soon to be in tow, I decided to build a house and that required a $250,000 mortgage. Only one problem: I did not have a job. Fender had shut down its Canadian operations and consolidated them with the U.S. Using my T4 (W-2 in the United States) from the year before to prove employment, I went to the bank and the loan was promptly approved. As a “consolation prize” for my years at Fender, Bill Schultz gave me the opportunity to liquidate all of the non-Fender inventory and pocket any profits that could be had. TMI (Fender Canada) distributed a number of other brands, including Alesis and Casio, so this netted me about $50,000, giving me a financial cushion to cover my monthly mortgage and other expenses.

At about the same time, I was asked to join Cabletek, the predecessor to Radial. As part of the deal, I had to match investment dollars with the inventory that my partner had already put in. It soon became apparent that we needed more cash to fund the growth, so I leveraged the value in my new house to get a loan to fund the company. Follow this through: I used past history to fund my house, money in savings to invest in inventory, and then my house to fund operations. When we started out, we paid ourselves the princely sum of $500 a month to cover the cost of two kids and a mortgage. I was leveraged to the neck and somehow I managed to keep all of the balls in the air.

Soon thereafter, a bomb dropped: The Canadian government got after me on the sales from Fender that I had not declared and it wanted cash. I negotiated monthly payments and eventually paid off the debt. Things were finally beginning to go well at Radial as sales steadily increased, as did our salaries.

Then, another financial bomb: Our bank manager walked in and told us that the TD Bank had changed its policy and decided to cull all accounts below a given size. Even though our financials were in good shape and Radial was finally profitable, they told us that we had to find another bank.

This led to another important lesson on finances: You would not believe how many times I have heard business owners say that they hate banks. This always confounds me. Banks are not venture capitalists. Venture capitalists lend money at high interest rates that are commensurate with the risks involved. Banks are not there to take risks; they offer low interest rates in exchange for security.

When I set up the meetings with various banks to find a new “partner,” I made sure that I had my financial advisor on my left and my in-house accountant on my right. I wanted to present “a picture” to the bank that we had our financial house in order and that we could be trusted to stay on top of cash flow. This proved to be a winning strategy as we got offers from three banks for our much-needed credit line. We chose HSBC and stayed with it for the next 20 years.

When the economy tanked in 2009, we reduced all staff hours to four days a week to ensure that we could cover our costs should things get really bad. The only exceptions were sales and marketing. I insisted that the sales team work extra hard by focusing on products that people need, not products that people want. We stepped up our advertising to take advantage of low page rates, increased our visibility and made sure the lifeblood of the company remained intact. The company continued to grow during this difficult period and after the financial slowdown, sales exploded.

As you can see, developing your business skill set—the abilities to be creative, to never give up and to find a path around obstacles—is an ongoing process. You’ll have to keep developing them throughout your career—and sometimes not by choice! In hard times, those skills will keep you from going under, and in good times, they’ll help you get ahead of the competition.

Peter Janis, former CEO of Radial Engineering, is a 40-year veteran of the music industry. Exit Plan (www.exit-plan.ca), his consulting firm, assists business owners to build their companies and prepare them for eventual sale.