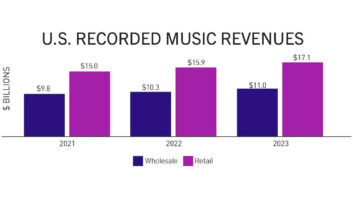

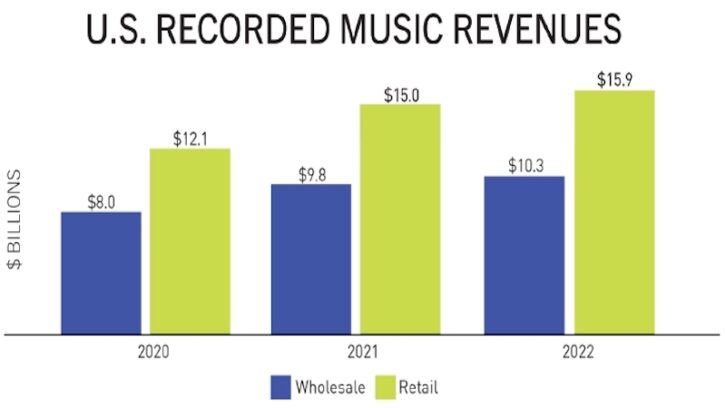

Washington, DC (March 9, 2023)—The RIAA is reporting all-time high recorded music revenues for the seventh straight year, growing 6% at retail to $15.9 billion, fueled by streaming and the ongoing resurgence of vinyl.

According to the RIAA’s 2022 Year-End Music Industry Revenue Report [READ THE REPORT HERE], streaming in all its forms—paid subscriptions, ad-supported services, digital and customized radio, social media platforms, digital fitness apps and others—accounted for the lion’s share of 2022 revenues, growing 7% to a new record high, $13.3 billion. Collectively, these services accounted for 84% of total 2022 revenues, up slightly from 83% in 2021.

Revenues from paid subscription services grew 8% to $10.2 billion, topping $10 billion annually for the first time—a new milestone. Those services accounted for 77% of streaming revenues and nearly two-thirds of total revenues.

Paid subscriptions to on-demand music services continued to grow at double digit rates, reaching a new average high in 2022 of 9 million, a 10% increase. That compares to an average 84 million paid subs in 2021. (These figures count multi-user plans as a single subscription and exclude limited-tier services.)

Craig Anderton’s Open Channel: Profiles in Gear Lust

Limited tier subscriptions—services like Amazon Prime, Pandora Plus, music licenses for streaming fitness services and other subscriptions limited by factors such as mobile access, catalog availability, product features or device restrictions—grew 18% to $1.1 billion.

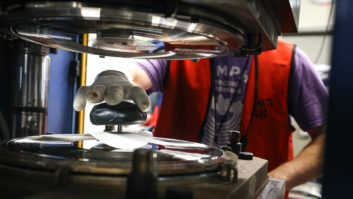

Revenues from physical music formats, which made a resurgence in 2021, continued to grow, and were up 4% to $1.7 billion from the previous year. Remarkably, vinyl sales are on a 16-year streak, growing 17% from 2021 to $1.2 billion and now accounting for 71% of physical format revenues.

Marking another milestone, vinyl albums outsold CD unit sales for the first time since 1987—41 million vs 33 million. CD revenues rebounded in 2021 following the 2020 COVID-19 slump, posting a 21% year-over-year revenue increase, the first since 2004, to $584 million. This past year, however, CD revenues fell 18% to $483 million.

For all the good news, 2022’s 6% growth is the lowest since 2015, which followed the essentially flat revenues of the record industry’s 2014 nadir. This past year is also the only year since the slump that has not seen double-digit growth, other than 2020’s pandemic-induced 9.2% revenue increase.

Meanwhile, digital downloads, which fell 12% in 2021, continue on a downward track, falling 20% to $495 million in 2022. Both digital album sales and individual track sales were down 20% to $242 and $214 million, respectively. Downloads accounted for just 3% of U.S. recorded music revenues in 2022, a far cry from the 2012 peak of 43%.

According to RIAA chairman/CEO Mitch Glazier, “2022 was an impressive year of sustained ‘growth-over-growth’ more than a decade after streaming’s explosion onto the music scene. Continuing that long run, subscription streaming revenues now make up two-thirds of the market with a robust record high $13.3 billion. This long and ongoing arc of success has only been possible thanks to the determined and creative work of record companies fighting to build a healthy streaming economy where artists and rightsholders get paid wherever and whenever their work is used.”